How COVID-19 Fueled Online Fraud Attacks

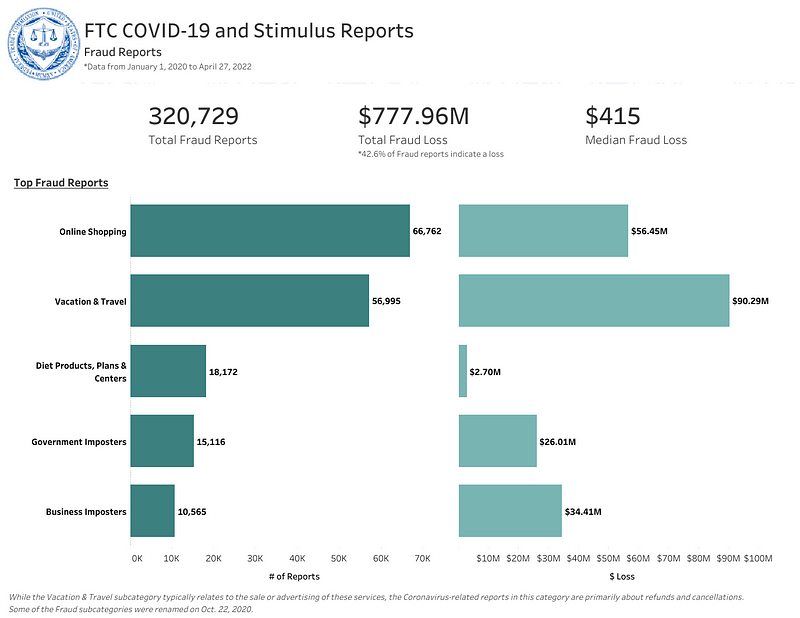

While the world was fighting the ongoing virus, COVID-19, scammers made it into an opportunity to come up with new ways to defraud more people. According to the US FTC, since the beginning of 2020, Covid-related frauds have cost US consumers more than $700 million in a variety of scams ranging from online shopping to travel.

In their “2020 Consumer Complaint Survey”, CFA reported that COVID-19 scams topped the list of complaints by agencies. Price gouging, which refers to sellers charging exorbitant prices to consumers for items of high demand, was on the top of the scam list. Customers complained of being charged excessive prices for products such as hand sanitizer, toilet paper, and face masks [1].

Common scams and fraud to watch out for

Email and social media Phishing

Phishing scams are tactics executed through diverse channels such as email and social media like Facebook, Instagram, Linkedin, or Twitter to trick victims into giving money and personal information or to gain control over their social media accounts. Criminals use spoofing techniques and design those scams to lure their target in and take the bait.

They may send you an email, or a DM on social media, that looks legitimate and asks you to verify, update or send personal information directly or through a phishing website. Those fake websites are created to look identical to the ones you are familiar with and deceive you to enter sensitive information like your bank account details and passwords.

Identity Theft

Identity theft occurs when a scammer steals your personal information to commit fraud and apply for credit cards, file taxes, or get medical benefits. A widespread mechanism was using vaccination cards posted by people on their social media.

Account Takeover

As more customers work and shop online, the threat of account takeover has increased. More online users and activities translate into a likely target base for fraudsters.

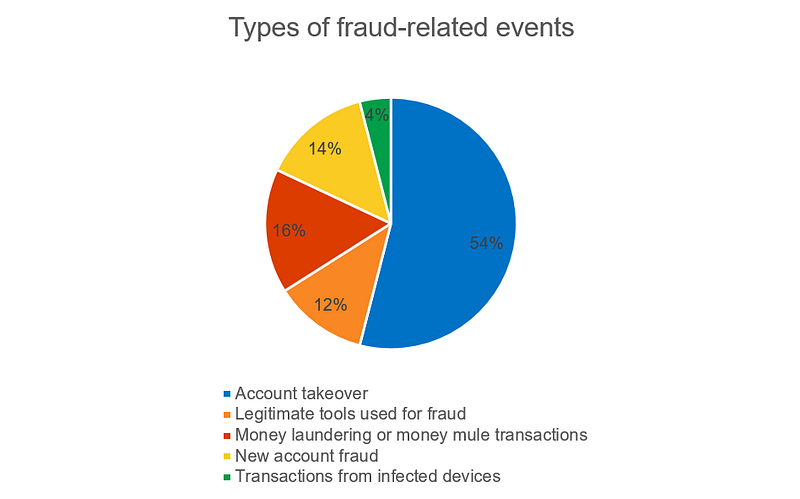

According to Kaspersky Fraud Prevention, in 2020, account takeover incidents increased from 34% to 54% compared to 2019 [2]. Also, the report found that every second fraudulent transaction in the finance industry was an account takeover.

Government Impersonation

Scammers reach out to their victims by imitating official institutions that promise urgent COVID-19 news or require you to receive a vaccine and ask you to click on harmful links, call a fake customer care number, or give sensitive information.

COVID-19 funeral assistance scam

Scammers pose as representatives from FEMA’s COVID-19 Funeral Assistance Program and offer program registration to family members of COVID-19 victims. Scammers can steal family members’ Social Security Numbers and other sorts of documents.

FDIC and banking scam

Scammers can impersonate the Federal Deposit Insurance Corporation (FDIC) or local banks and call to inform you that your bank account is unprotected and ask for your personal information to provide protection.

Bank loan scam

The pandemic led more customers to shop online which increased the number of bank loan scams. Related frauds increased 42% during the pandemic compared to the previous year, as fraudsters took advantage of the fact that many shops went out of business and were forced to close[3].

COVID-19 fraudulent websites

Registered domain names that contain “Covid” have risen significantly in the last few years, which increases the likelihood of people coming across those domains and hyperlinks, which exposes them to scam attacks [4].

Health provider and supply scams

Fraudsters are pretending to be medical supply companies offering to sell medical supplies to protect against the virus. They may create fake websites for their fake products: vaccines, natural treatments, and medications at low prices and then steal credit card information or demand payment upfront before delivering the products.

Charity scams

Nationwide, fake charities popped up during the pandemic claiming to be real charities and nonprofit organizations that collect funds and solicit donations for individuals, groups, and areas affected by COVID-19.

Mobile app scams

Some fraudsters developed mobile applications (apps) that track the spread of COVID‐19, similar to other legitimate tracking apps. However, once installed, the application infects the user’s device with malware which can be used to obtain personal information, sensitive data, or bank account/card details. In some cases, the malware can turn out to be ransomware, which encrypts user’s files on the device and asks for a ransom to give the access back to the user.

Fake tech support

Scammers send you a phone call, email, or pop-up warning indicating your computer/phone is infected and offer help for a fee or suggest downloading a malicious application or files.

Best practices to protect yourself and avoid pandemic scammers

The pandemic and related disasters are the perfect opportunities for scammers to prey on vulnerable people who attempt to protect themselves and their families. Here is what you can do to protect yourself from potential cybercrimes:

-

- Get the recent news about COVID-19 vaccines and medications distribution channels from the official health website of your country.

-

- Don’t give out your personal or medical information to anybody other than trustworthy medical professionals.

-

- Check your medical documents (bills and insurance explanation of benefits) and report any suspicious claims or errors.

-

- Discuss with your doctor before using any vaccination or medication.

-

- Donate directly via a reputable nonprofit’s website instead of clicking on suspicious links you receive by email or DM.

-

- Be extremely cautious online by verifying the sender, links, and attachments of received messages and DMs. Also, Follow other cybersecurity advice mentioned in this article.

Online brand protection using Eydle

Eydle platform helps secure your social media presence and protect your brand from cybersecurity threats using AI and deep learning technology. To understand how the Eydle platform can identify and take down impersonation accounts on social media, contact us at [email protected] or visit www.eydle.com.

References

[1]https://consumerfed.org/reports/2020-consumer-complaint-survey-report/

[2]https://www.kaspersky.com/about/press-releases/2021_share-of-account-takeover-incidents-increased-by-20-percentage-points

[3]https://www.bbc.com/news/technology-56499886

[4]https://blog.checkpoint.com/2021/03/04/rise-in-vaccine-related-domain-registrations/

[5]https://www.fbi.gov/news/press-releases/press-releases/federal-agencies-warn-of-emerging-fraud-schemes-related-to-COVID-19-vaccines

[6]https://home.kpmg/be/en/home/insights/2020/05/rc-beware-of-COVID-19-frauds-scams.html

[7]https://www.investopedia.com/articles/personal-finance/040115/watch-out-these-top-internet-scams.asp