Over two-thirds of the world’s population is now online. More users are connecting and sharing information on the internet than ever before. This has exposed them to scam risks such as phishing and identity theft.

Identity theft occurs when a malicious actor acquires access to your personal information without your knowledge or permission. This scammer may use your information for different purposes: start credit accounts, apply for jobs, buy insurance, and so on.

In this article, we are going to explain identity theft types, how to figure out if your identity has been stolen and how to protect yourself from this scam.

Identity theft types

Identity theft can surface in several forms:

Financial identity theft

In a financial identity theft attempt, the scammer gets unauthorized access to your bank and credit card accounts or uses your Social Security Number to obtain a new credit card to steal money or make purchases on your behalf.

Medical identity theft

Medical identity theft occurs when criminals use your personal information to impersonate you and obtain medical services, purchase prescription medicines, or access your health insurance benefits, for example, getting an expensive surgery in your name. You will not find out about it until you get a bill notification on your phone or in your mailbox. This scheme can lead to huge money loss, suspension of medical benefits, and sometimes, missing out on crucial medical appointments because the scammer changed the medical report.

Criminal identity theft

In this identity theft type, the criminal possesses your credentials, for example, your driver’s license or ID card and provides them to law enforcement officers, instead of their own ID, when they get arrested. Afterward, you will discover that you have unpaid speeding tickets or other violations.

Synthetic identity theft

Synthetic identity theft is creating fake identities using real people’s information like people’s birthdays, home address, and Social Security Numbers. They can then use this identity to commit financial crimes such as getting loans in victim’s name.

This type of fraud affects mostly children and the elderly since they rarely monitor or use their Social Security Numbers. Unused SSNs often make their way into ID theft scams.

Child identity theft

Because most children do not have credit cards, it is feasible for fraudsters to create fake credit accounts in their name to perpetrate financial fraud, such as creating a bank account or a line of credit in the kid’s name, obtaining a driver’s license, asking for government assistance, or purchasing a home. Some victims of child identity theft remain unaware of the crime until they apply for a college loan or a job later in their life.

Tax identity theft

Tax identity theft occurs when a fraudulent tax return is filed in your name. Most likely, the scammer will declare fictitious income and attempt to obtain a hefty refund from the IRS (Internal Revenue Service).

Government benefits theft

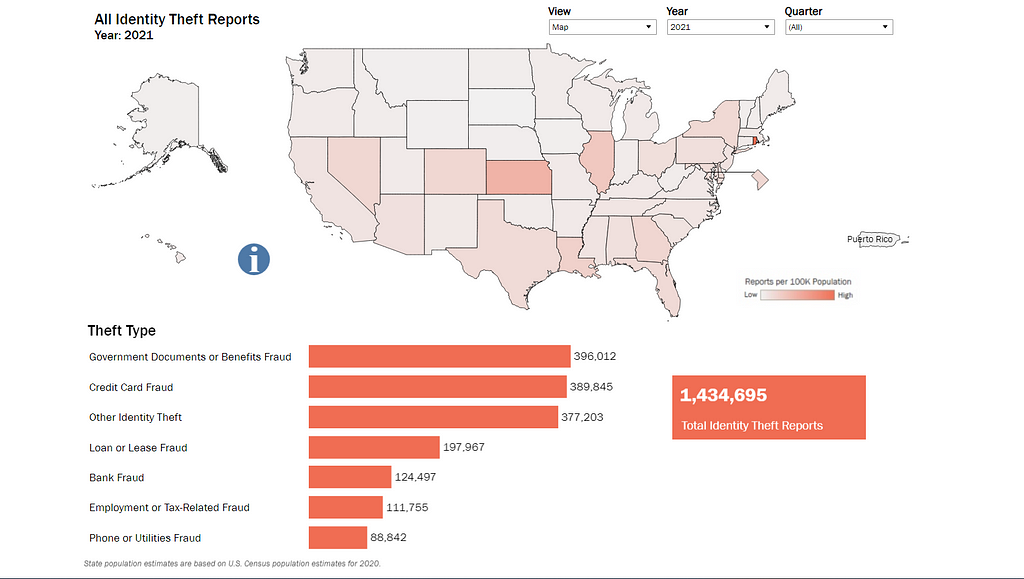

According to the FTC [1], government benefits fraud was the most common sort of identity theft in 2021 due to new policies and benefits created in the wake of Covid.

Unemployment benefits and the pandemic Paycheck Protection Program (PPP fraud) are popular targets for fraudsters.

A fraudster can exploit your identity to file false unemployment claims. Alternatively, they may call you pretending to be from a government body and stating that you were overpaid and owe money.

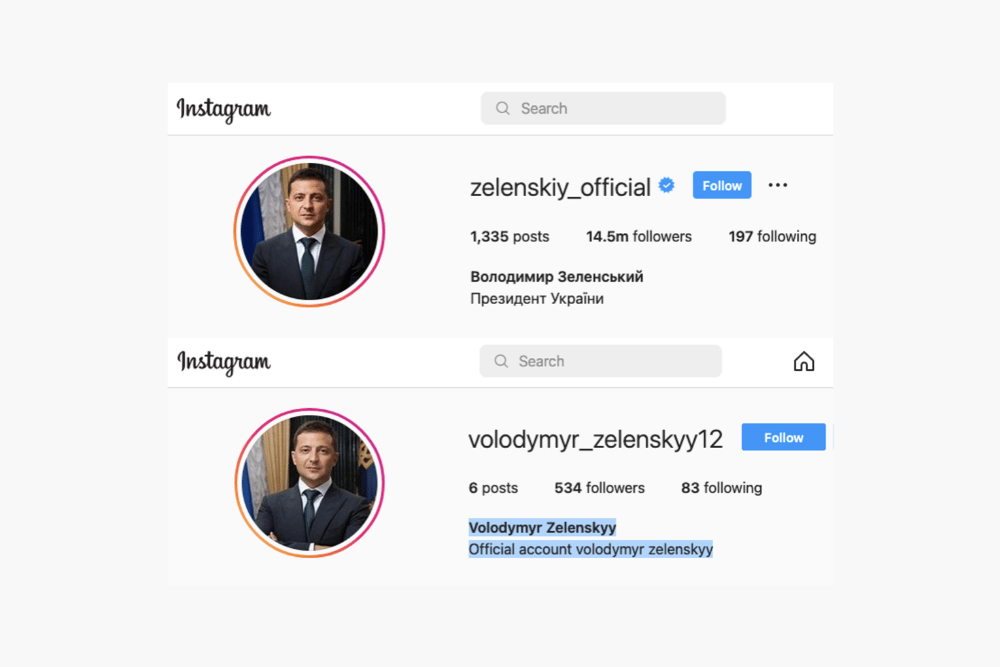

Identity theft on social media

Fraudsters can now impersonate you and your business on social media like Facebook, Instagram, LinkedIn, and Twitter and target your followers to steal their money or personal information [3].

Warning signs of identity theft

If you notice unusual charges on your credit card report, for example, transactions you didn’t make, a sudden decline in your credit score, or you are unable to access your online banking account, these are signs of ID theft. Other signs:

- Unusual medical costs and changes in your medical record.

- Sudden changes in the insurance information.

- Your child starts receiving messages/letters about unpaid taxes or credit card solicitations or being refused a government benefit.

- You receive unexpected warrants or summons to appear in court for violations you don’t know about [4].

How to protect your identity

You can avoid identity theft by taking precautions to safeguard your personal information. Here’s what you can do:

- Keep all your documents such as credit card, bank information, and Social Security Number in a safe location whether in a physical or digital folder. If sensitive documents are not needed anymore, shred them before throwing them in a recycling bin.

- Before you provide your Social Security Number to an institution, double-check on them online and make sure to know why they require it. Ask if they have an alternate, safer way to register you in their system.

- Use a strong password and multi-factor authentication to protect your personal information from online and phone fraudsters.

- Follow the news to learn about phishing scams and how to identify them, and be careful when sharing personal data on social media.

- Check your bank and credit reports regularly and set up alerts when a new change is made.

What you can do if your identity is stolen

Anyone can be a victim of identity theft. Therefore, if you noticed any of the previous warning signs, you need to take action immediately:

- Contact your banks to freeze your accounts like credit cards and bank accounts.

- Change passwords and logins of compromised accounts. Do it before the scammer does it.

- Report identity theft to the FTC.

- File a report with local law enforcement in your area [5].

Protect your online identity today

Browse social media with no worries with Eydle’s AI-powered protection system. With 24/7 monitoring, we detect all malicious actors trying to impersonate you or your company on social media, so you can focus on your business. Contact us at [email protected] or visit www.eydle.com.

Resources:

[1] https://www.statista.com/statistics/194017/identity-theft-complaints-in-the-us-by-nature-of-crime/

[3] https://www.mcafee.com/blogs/privacy-identity-protection/5-common-types-of-identity-theft/

[4] https://www.identitytheft.gov/#/Warning-Signs-of-Identity-Theft

[5] https://www.identitytheft.gov/#/Steps

How to Find Out if Your Identity Has Been Stolen was originally published in Eydle on Medium, where people are continuing the conversation by highlighting and responding to this story.