As digital banking grows, so do financial scams. To tackle this, the EU and UK have introduced new regulations to protect online consumers from scammers. This article will explain these regulations, how they help keep consumers safe, and their impact on e-commerce platforms.

Common Bank Scams

Scammers use various methods to steal money from bank accounts. Here’s how these scams typically work [1] [2] [3] [4]:

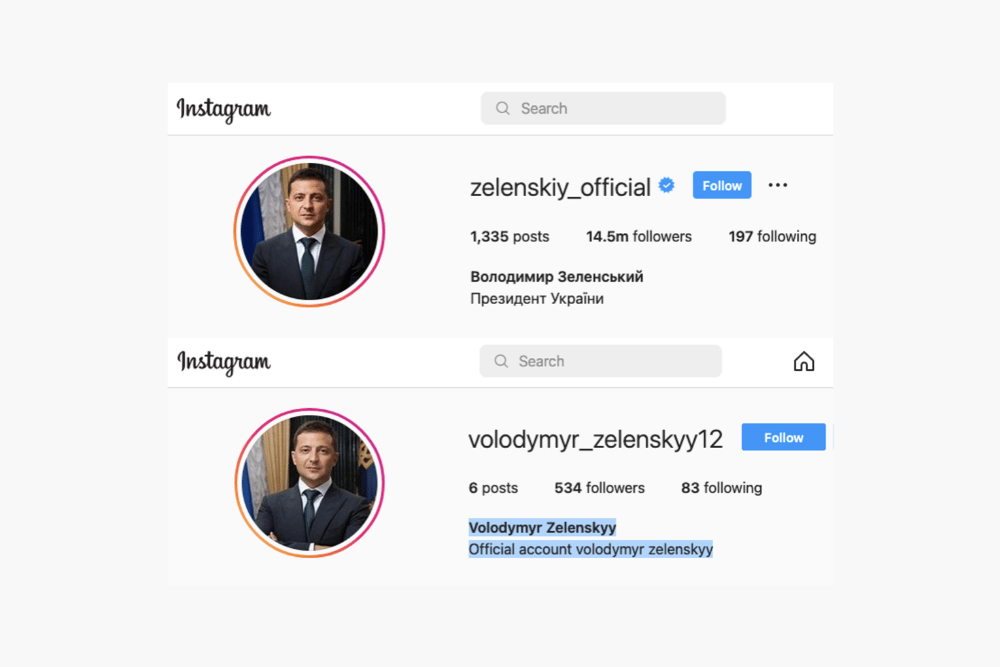

1. Impersonation Scams: Scammers pretend to be trusted figures or institutions to trick you into giving up sensitive information or transferring money. Common scenarios include:

- Bank Representative Impersonation: Scammers reached out to you through email, calls, or social media pretending to be from your bank and claiming there is a problem with your account. They then ask for account details, and passwords, or prompt you to transfer money to a ‘safe’ account they control.

- Government Agency Impersonation: Fraudsters pose as officials from tax authorities or other government agencies, claiming you owe money or are due a refund. They ask for personal and banking information to resolve the issue.

- Tech Support Scams: Scammers pretend to be from reputable tech companies, claiming your computer is infected with a virus. They request remote access to fix the issue, which they then use to steal banking information or install malware.

2. Check Overpayment: Scammers pay for something with a check that’s too much. They ask for a refund, but the check is fake.

3. Cash Check for Someone Else: Strangers ask you to cash a check because they can’t. The check turns out to be fake, and you lose money.

4. Job Scams: Scammers offer easy work-from-home jobs, but they’re just trying to access your accounts and steal your money. Avoid jobs that ask for upfront payments or promise big rewards.

5. Advance-Fee Scam: Scammers ask for money upfront for a promised product or service. Be careful with unsolicited offers and check if the seller is legit before paying.

6. Fake Check Scam: Scammers pay for goods or services with a phony check. It can take days for the bank to process the check and flag it as counterfeit.

7. Non-existent Investment Scam: Scammers pose as bank representatives offering bogus investment opportunities. They aim to get you to transfer money or enter login information on fake websites. Look for the legitimacy if the investment offer through official bank channels.

8. Automated Payment Scam: Scammers set up automatic payments using your account information to siphon funds over time.

9. Card Skimming: Scammers attach devices to ATMs or payment terminals to steal card information that’s why you need to check for any suspicious devices on ATMs and cover your PIN when entering it.

New UK and EU Legislation to Combat Bank Scams and Protect Consumers

Authorized Push Payment (APP) fraud occurs when criminals deceive individuals into transferring money or revealing personal information under false pretenses. Fraudsters often impersonate legitimate businesses or government entities to gain the victim’s trust, leading to substantial financial losses.

To combat APP fraud, the UK government is proposing new legislation allowing banks to delay suspicious transactions by up to four days. This shift from the UK’s real-time payment system aims to give banks more time to investigate potentially fraudulent activities, addressing the £485 million lost to APP fraud in 2022, with 70% of these offenses linked to overseas criminals [5].

At the same time, the European Parliament has made new rules to make money transfers in the EU faster. Now, when you send money to someone in the EU, it should reach them in just ten seconds. This helps everyone, making payments quicker and safer. Payment Service Providers (PSPs) must implement robust fraud detection systems and allow clients to set transaction limits. Non-compliance can result in significant penalties, including liability for financial damages. This legislation marks a milestone in EU payment modernization, with technology, particularly machine learning, playing a crucial role in compliance and fraud prevention, enhancing transaction security and consumer trust [6].

Overall Impact on E-commerce Platforms

E-commerce platforms must stay updated with both UK and EU regulations to ensure compliance and avoid any legal repercussions by implementing advanced fraud detection systems and prevention technologies.

Prevention tips for bank scams:

- Use strong, unique passwords, and avoid using the same password across multiple sites.

- Enable two-factor authentication (2FA) for an added layer of security.

- Check bank statements frequently to spot unauthorized transactions early.

- Avoid sharing personal information through unsolicited emails, texts, or phone calls.

- Use antivirus software and keep devices updated to protect against malware.

Bank scams are a growing threat, targeting individuals and businesses alike by stealing money and personal information. At Eydle, we are dedicated to protecting businesses from online scammers who try to damage their reputation and trust, including those involved in bank scams. Our smart computer systems find fake posts, logos, accounts, comments, and profiles keeping you safe from online fraudsters. With a team of AI experts from MIT, Stanford, and Carnegie Mellon, we’ve created the Eydle tool to keep your business safe from these bad actors.

Learn more about how we can protect you by visiting www.eydle.com or emailing us at [email protected].

Sources:

- https://us.norton.com/blog/online-scams/types-of-phishing

- https://www.texasattorneygeneral.gov/consumer-protection/financial-and-insurance-scams

- https://lifelock.norton.com/learn/fraud/bank-scams

- https://lifelock.norton.com/learn/fraud/tax-impersonation-scams

- https://www.thebanker.com/UK-proposes-rules-to-help-banks-mitigate-APP-fraud-risk-1710408314

- https://trustfull.com/articles/preventing-fraud-in-instant-payments-new-eu-psp-responsibilities0

- https://www.chase.com/digital/resources/privacy-security/security/how-to-spot-scams