Credit card fraud is a growing concern in today’s digital era, affecting millions worldwide. In 2023, approximately 60% of credit card holders experienced attempted fraud, as reported by Experian [1].

This article will explore the most common types of credit card fraud, highlight what financial institutions do to prevent it and share practical tips to protect your card from scams.

Credit Card Scams to Watch for

Credit card fraud is the unauthorized use of a debit or credit card to make purchases, withdraw cash, or even open new accounts in your name. Here are some common types of credit card fraud [2][3]:

Phishing Scams: Fraudsters send fake emails and messages pretending to be from trusted sources like banks or credit card companies. This technique often uses social engineering to psychologically manipulate individuals into sharing sensitive data such as card numbers or login credentials. For example, you might get a message asking you to “verify” your account by clicking a link, which leads to a fake website or installs malware, enabling scammers to steal login credentials, access app data, or monitor your screen.

Card Skimming: Criminals use devices called skimmers to steal credit card information. These are often placed near a card reader such as ATMs or gas pumps. For instance, when you insert your card, the device reads and collects your card number and PIN so the scammer can retrieve it later.

Identity Theft: Identity theft happens when someone uses your personal or financial information without your permission. They may use it for different reasons; one is to open a new credit card account with your name. Victims often discover this fraud only after checking their credit score or receiving unexpected bills.

Online Shopping Scams: Scammers create fake websites or marketplaces to lure victims with attractive deals and push them to give their credit card information. After paying, the scammer disappears and the victim never receives the order. For instance, a scam site might advertise a high-end product at a suspiciously low price and limited deals.

Account Takeover: In this type, fraudsters hack into an existing credit card and use it to make purchases. They might also change contact details, making it harder for the actual owner to detect unauthorized activity.

Card Cracking: Fraudsters use automated bots to guess missing card values, such as expiration dates or security codes, by testing combinations repeatedly so they can use the credit card.

Data Breach: Your credit card information can be exposed during data breaches or leaks at companies where it’s stored. In 2023, 353 million people in the U.S. were affected by such incidents, allowing cybercriminals to misuse or sell the stolen information.

Theft: Sometimes, it’s as simple as stealing a card from someone’s wallet or copying details during a legitimate transaction. Theft can also occur when a friend or family member uses a stored credit card for online purchases without permission.

What Financial Institutions Are Doing to Prevent Credit Card Fraud

Financial institutions are adopting measures like delaying suspicious transactions, leveraging machine learning for fraud detection, and enabling transaction limits to safeguard consumers. These steps, supported by UK and EU regulations, aim to enhance security and consumer trust while reducing financial losses.

For more details, read the full article on Eydle: New UK and EU Legislation to Combat Bank Scams and Protect Consumers.

How to secure your credit card

Securing your credit card is crucial in today’s digital age to protect against fraud and identity theft. Here are some comprehensive steps to safeguard your information [4] [5]:

- Set a Good Security Foundation: Use strong, unique passwords for your accounts by avoiding personal details like birthdays, and don’t forget to activate account alerts to monitor unusual activities.

- Limit Your Risk with One Account for Online Shopping: Use a single credit card for all online purchases. This reduces exposure to hackers and makes monitoring easier. Some banks provide special cards for online use, and enabling alerts for each transaction ensures you stay informed. When shopping, choose the “guest checkout” option to avoid storing your card details on websites.

- Never Share Account Information: Don’t share your credit card number by email or DMs. Whenever needed, do it privately, not in a public space. Also, social security numbers are rarely needed for purchases; if requested, consider it a red flag. Lastly, make sure to shred outdated statements or opt for paperless billing to minimize risks.

- Follow Security Practices: Always make sure you are shopping from secure websites with “https” and avoid saving credit card details in autofill in your browser. Also, use a private network instead of public Wi-Fi for transactions, as the latter exposes your data to hackers and always log out of the website especially if you are using a shared computer.

- Use Security Software: Install antivirus or comprehensive security software on all devices, including mobile ones, to prevent malware or hacking attempts during online shopping.

- Watch Out for Phishing: Be cautious of unsolicited calls, DMs, emails, or links that ask for sensitive information like credit card data. Phishing scams could mimic banks but contain subtle typos or variations in email addresses, or profile names. Your bank will never require you such information online. Report such attempts immediately to your financial institution to protect yourself and others.

How Eydle Can Help Protect Your Business from Online Scams

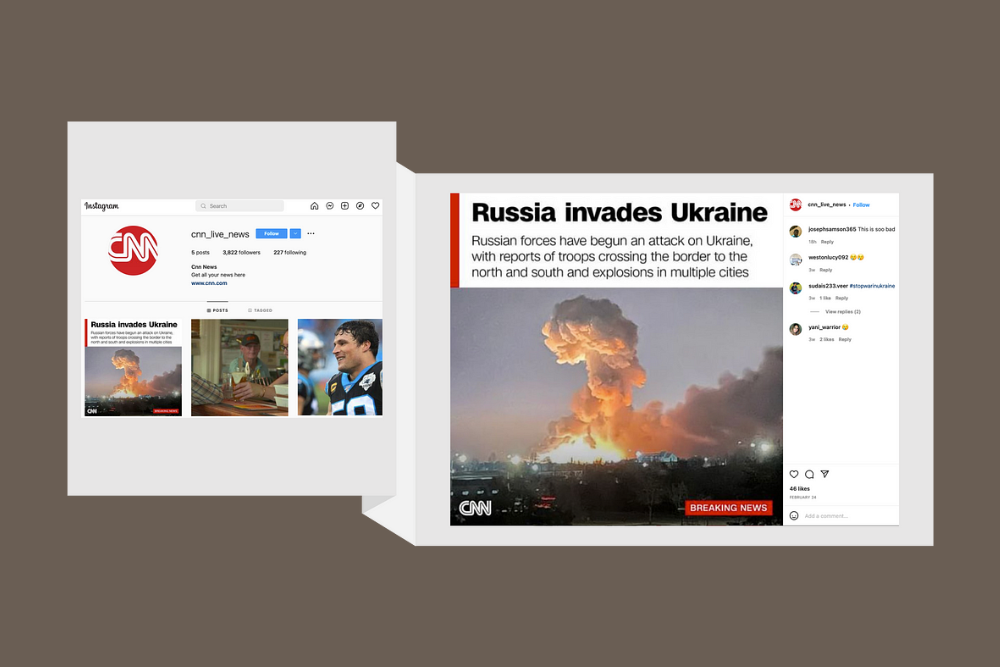

Most scams originate on social media, making it crucial for businesses to safeguard their online presence and protect their customers from fraud.

At Eydle, we collaborate with top experts from MIT, Stanford, and Carnegie Mellon to develop a system that monitors your social media profiles, detects fake accounts, and identifies fraudulent comments that could put your customers at risk.

Adding an extra layer of security with Eydle is essential for your business. Learn more at www.eydle.com or reach out to us at [email protected].

Sources:

- https://www.cnbc.com/2024/09/12/why-credit-card-fraud-alerts-are-rising.html

- https://datadome.co/learning-center/types-of-credit-card-fraud/

- https://www.forbes.com/advisor/credit-cards/how-to-prevent-credit-card-fraud/

- https://www.kaspersky.com/resource-center/preemptive-safety/protect-your-credit-card-online

- https://www.chase.com/personal/credit-cards/education/basics/credit-card-safety